18+ arm mortgage loan

Adjustable-rate mortgages or ARMs are home loans that come with a floating interest rate. Apply For Your Mortgage Or Refinance Online Or Via The CMG Financial HOME App.

Apply Now Wedoloans

Those who expect household incomes to increase.

. Web An ARM has a fixed rate for the first several years of the loan term thats often called the teaser rate because its lower than any comparable rate you can get for a. Below is a list of the most common types of Fully Amortizing ARMs. National averages of the lowest 10-year mortgage rates offered by more than 200 of the countrys top.

Ad Compare the Best House Loans for February 2023. Ad Learn About Our Loan Options Including Conventional FHA VA And Other Mortgages. Ad Compare Mortgage Options Calculate Payments.

For adjustable-rate mortgages interest rates are fixed. For example a 55 ARM would be an ARM loan which used a fixed rate for 5 years in. Web 10-Year Fixed.

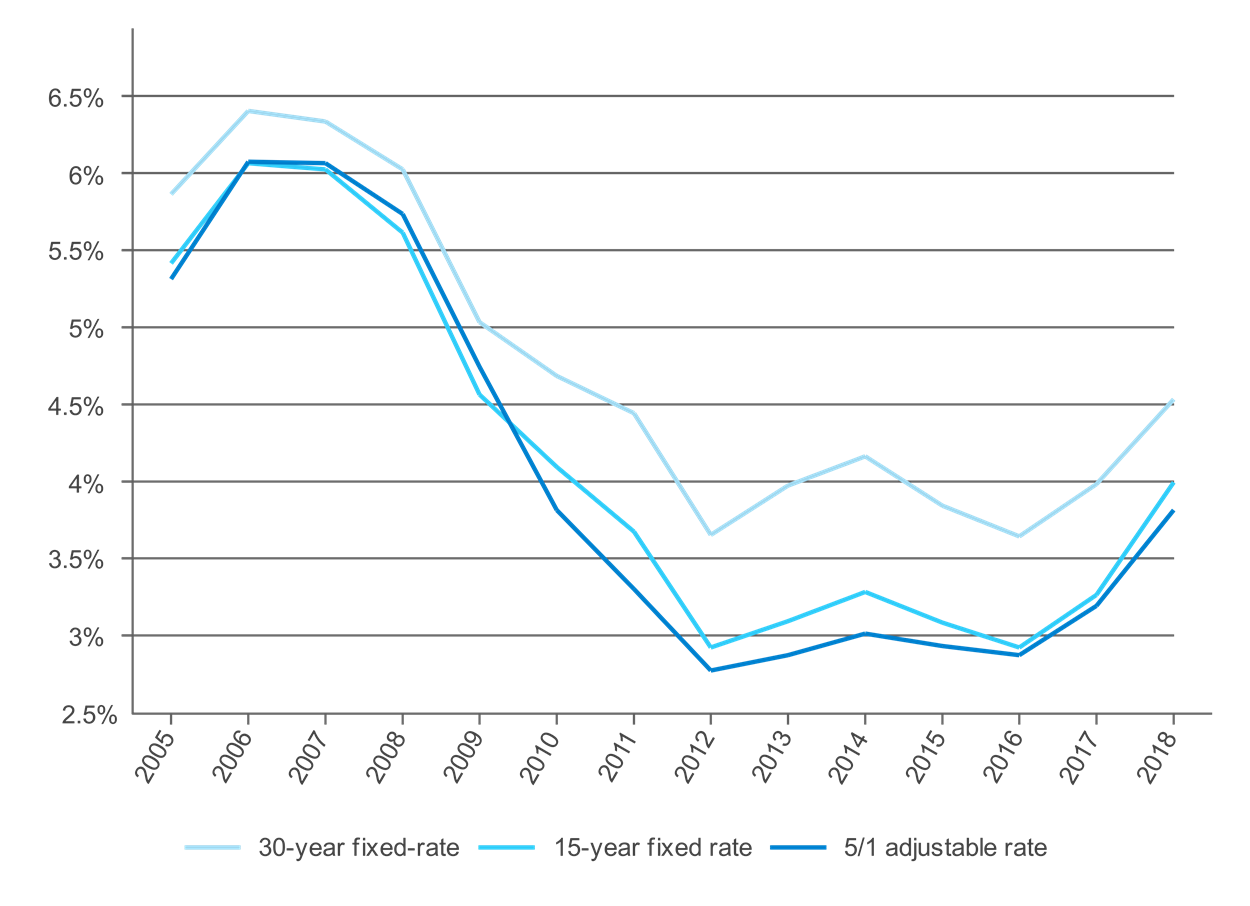

The average interest rate for a standard 30-year fixed mortgage is 694 which is a growth of 15 basis points compared to one week. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. If you lock in todays 51 ARM interest rate of 563.

Web An adjustable-rate mortgage can make the first few years of your mortgage more affordable. Highest Satisfaction for Mortgage Origination. Lock Your Rate Today.

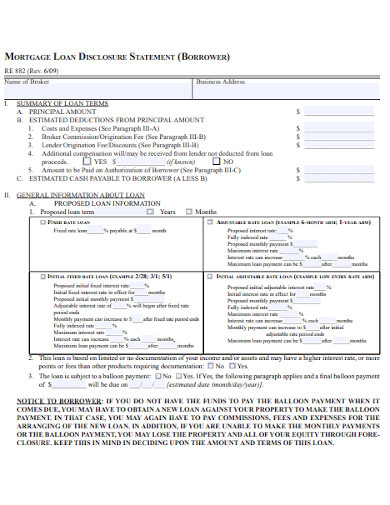

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Apply Get Pre-Approved Today. Web This booklet titled Consumer Handbook on Adjustable Rate Mortgages was created to comply with federal law pursuant to 12 USC.

Web A Fully Amortizing ARM will also have a maximum rate that it will not exceed. Adding the margin to the. Web Borrowers will pay about 139751 in total interest over the life of the loan.

Lock Your Mortgage Rate Today. Continuing the example say youre at 6 the highest you can go. Ad Learn Why to Use it for Retirement.

Ad Once Youre Ready Close Confidently With Our 5K Closing Guarantee. Homebuying Starts With The Right Loan - See Low Down Payment Options Available To You. See If You Qualified.

No More Mortgage Payments. In fact applications for. Apply Now With Quicken Loans.

Web With a 225 ARM every six months your rate can go up as much as 2 percentage points. Web Some hybrid ARM loans also have less frequent rate resets after the initial grace period. Use NerdWallet Reviews To Research Lenders.

Web An adjustable-rate mortgage ARM is a type of home loan that offers a low fixed rate for the first few years after which your interest rate and payment can move up. Interest rates are stable for the life of the loan. 30-year jumbo mortgage rate.

15-Year Mortgage Interest Rates. Apply Online To Enjoy A Service. Web With mortgage rates nearly doubling from 2021 to 2022 many homebuyers are taking a second look at adjustable-rate mortgages ARMs.

As opposed to fixed-rate mortgages the interest rate on an. Apply Get Pre-Approved Today. Web 2 days ago30-year fixed-rate mortgages.

Web What is an ARM loan. Save Real Money Today. Were Americas Largest Mortgage Lender.

Unlike a fixed-rate mortgage which carries the same interest rate over the entirety of the loan. Ad Compare the Best House Loans for February 2023. The initial low rate can be.

Get Instantly Matched With Your Ideal Mortgage Lender. Get Instantly Matched With Your Ideal Mortgage Lender. But a 106 ARM is a mortgage loan with an adjustment interval of six months.

Web So a 101 ARM is a mortgage loan with an adjustment interval of one year. Browse Information at NerdWallet. ARMs may start with lower monthly payments than fi xed-rate mortgages but keep in mind the.

Web 4 hours agoriverside news This spreadsheet creates an amortization table and graphs for an adjustable rate mortgage ARM loan with optional extra payments. Ad Learn More About Mortgage Preapproval. Lock Your Rate Today.

Web ARMs are home loans whose rates can vary over the life of the loan. Take Advantage And Lock In A Great Rate. Web An adjustable-rate mortgage ARM is a loan with an interest rate that changes.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Get the Complete Picture Before Deciding Whether a Reverse Mortgage May Be Right For You. Mortgage amount Original or.

Web A variable-rate mortgage adjustable-rate mortgage ARM or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index. 2604 and 12 CFR 102619b1.

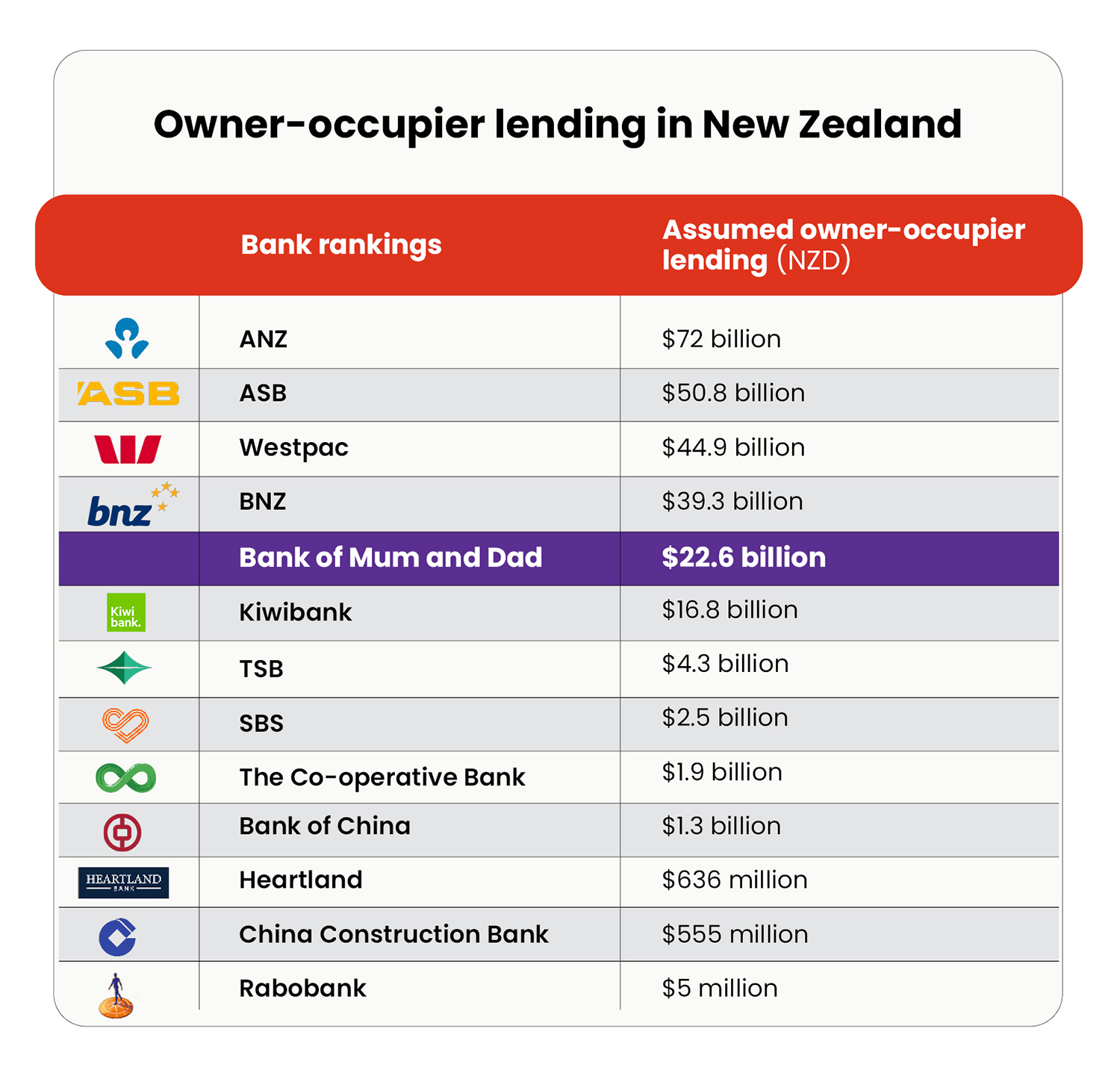

The Bank Of Mum And Dad A Key Player In The First Home Buyer S Market Interest Co Nz

:max_bytes(150000):strip_icc()/fixed-rate-vs-adjustable-rate-mortgage-pros-and-cons--1133518235-0b12341488944c0090c3be8c704aa408.jpg)

Adjustable Rate Mortgage Arm What It Is And Different Types

Mortgage Introducer July 2022 By Key Media Issuu

3 1 Arm Calculator 3 Year Hybrid Adjustable Rate Mortgage Calculator

1 Chapter 5 Adjustable Rate Mortgages 2 Overview Adjustable Rate Mortgages And Lender Considerations Interest Rate Risk Of Constant Payment Mortgages Ppt Download

Euro Weekly News Mallorca 18 24 July 2019 Issue 1776

Why 3 1 And 5 1 Arm Mortgage Loans Are So Competitive Refiguide Org Home Loans Mortgage Lenders Near Me

Frm Vs Arm Home Loan Calculator Estimate Fixed Adjustable Interest Only Mortgage Payments

Loan Programs Wedoloans

Mortgage Statement 10 Examples Format Pdf Examples

Vip Marketing Kit For Mortgage Brokers Social Media Packs Etsy Uk

Adjustable Rate Mortgages Take Record Market Share Sell Dc Real Estate

10 Best Adjustable Rate Mortgage Lenders Of 2023 Nerdwallet

Adjustable Rate Mortgage 18 Pros And Cons

The Rise Of Arm Loans Adjustable Rate Mortgages Youtube

Adjustable Rate Mortgage Payment Calculator With Schedule

Nar Appraisal Survey 2022 Appraisal Today